Insulet: The Game |

您所在的位置:网站首页 › games amazon games › Insulet: The Game |

Insulet: The Game

|

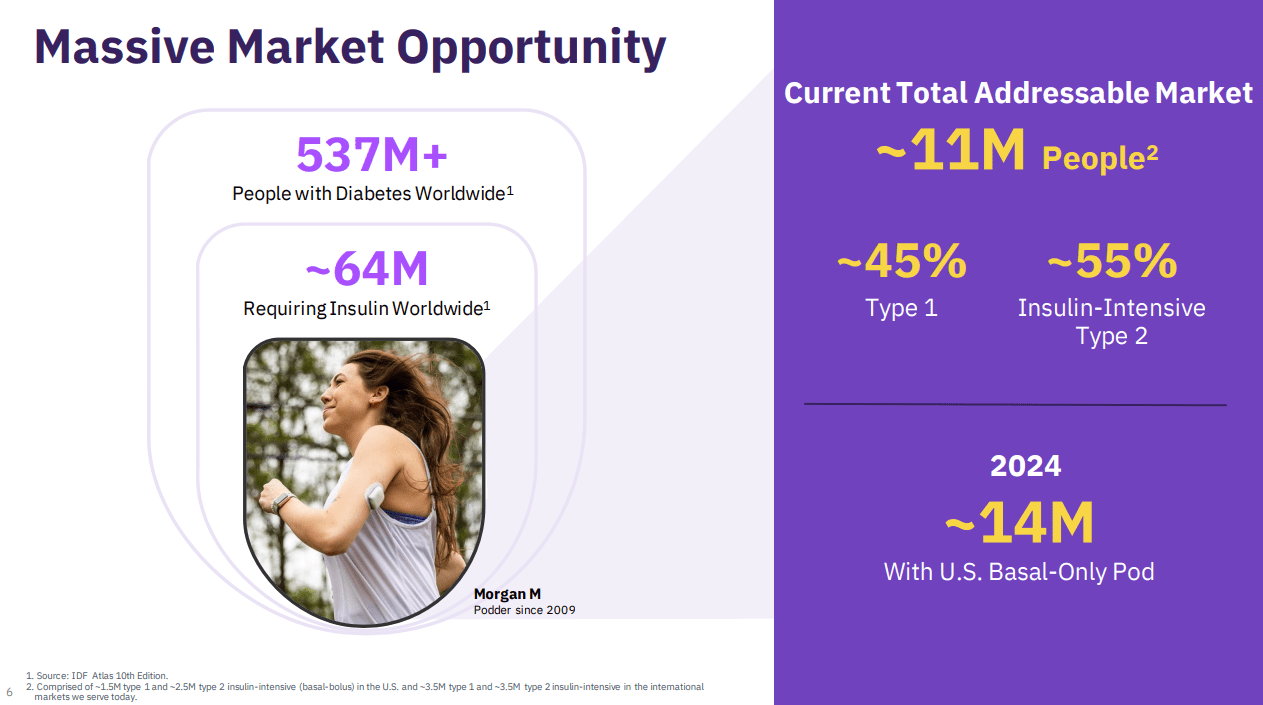

romaset/iStock via Getty Images Insulet Corporation (PODD) is a leading medical device company that is dedicated to creating advanced insulin delivery systems for individuals with diabetes. Their flagship product is designed to improve the lives of people with diabetes by providing a unique product platform. One of PODD's latest innovations is the Omnipod 5, which is an automated and tubeless insulin delivery system that can be fully controlled through a compatible personal smartphone. This advanced technology is set to revolutionize the way people manage their diabetes, offering increased convenience and flexibility. Notably, Omnipod 5 is the first tubeless automated insulin delivery system for a diverse age range available in the US. This innovation sets them apart from the competition and supports its high valuation multiple compared to its peers. Company OverviewIn FY'22, PODD achieved remarkable growth in its top line, with revenue reaching $1,305.3 million, up from $1,098.8 million the previous year. This can be attributed to the successful adoption of its innovative Omnipod system by a vast customer base. According to the management, they currently have around 360,000 active users globally, with over 100,000 customers relying on Omnipod 5, which represented over 90% of new US customer starts in Q4. The management also expects continued growth in its total addressable market. In fact, they estimated that approximately 40% of the type 1 diabetes population in the US and a smaller percentage of the insulin-intensive type 2 diabetes population in the US use insulin pump therapy.

PODD: Growing TAM (Source: Investor Presentation) PODD's management team has expressed its optimism for the company's future growth prospects. In fact, according to management, the commercialization of its type 2 basal-only pod is expected to be completed by 2024 and will be a key driver for sustainable growth. Additionally, it has completed the 510(k)-submission process. With this new addition to the company's portfolio, it will expand its customer base further and solidify its position as a market leader, as quoted below. We expect to build on our leading competitive position in this market as well as expand our total addressable market with the planned 2024 commercialization of our new basal-only pod. This will be a unique product for the type 2 market and will provide us with early entry into the treatment experience and help patients become comfortable with the Omnipod on-body experience. We believe this innovation will offer users a clear pathway to adopt Omnipod 5 as their insulin needs progress. We estimate the total addressable market for our basal-only pod is approximately 3 million people in the U.S. alone, doubling our U.S. TAM. Source: Q4'22 Earnings Call Transcript

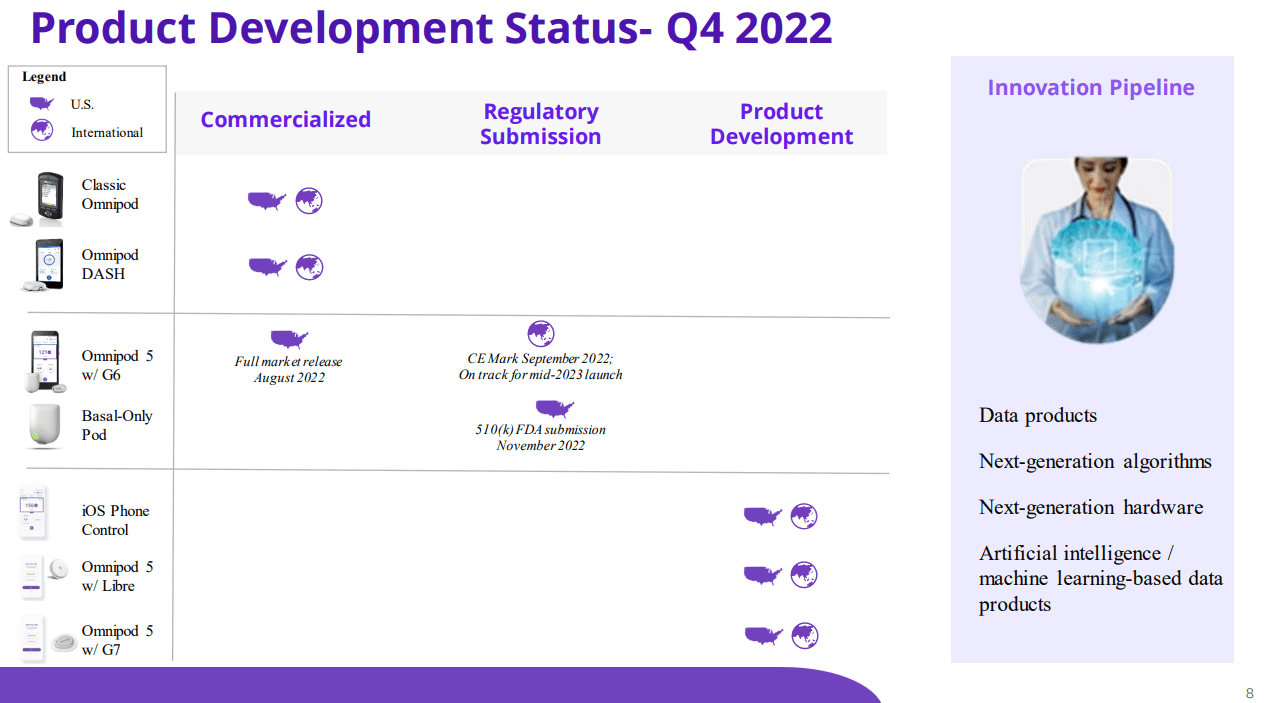

PODD Says There's More (Source: Earnings Call Presentation) The management's optimism regarding PODD's long-term growth potential is not surprising, given the innovative pipeline displayed in the image above. In fact, management provided a positive outlook as shown in the image below.

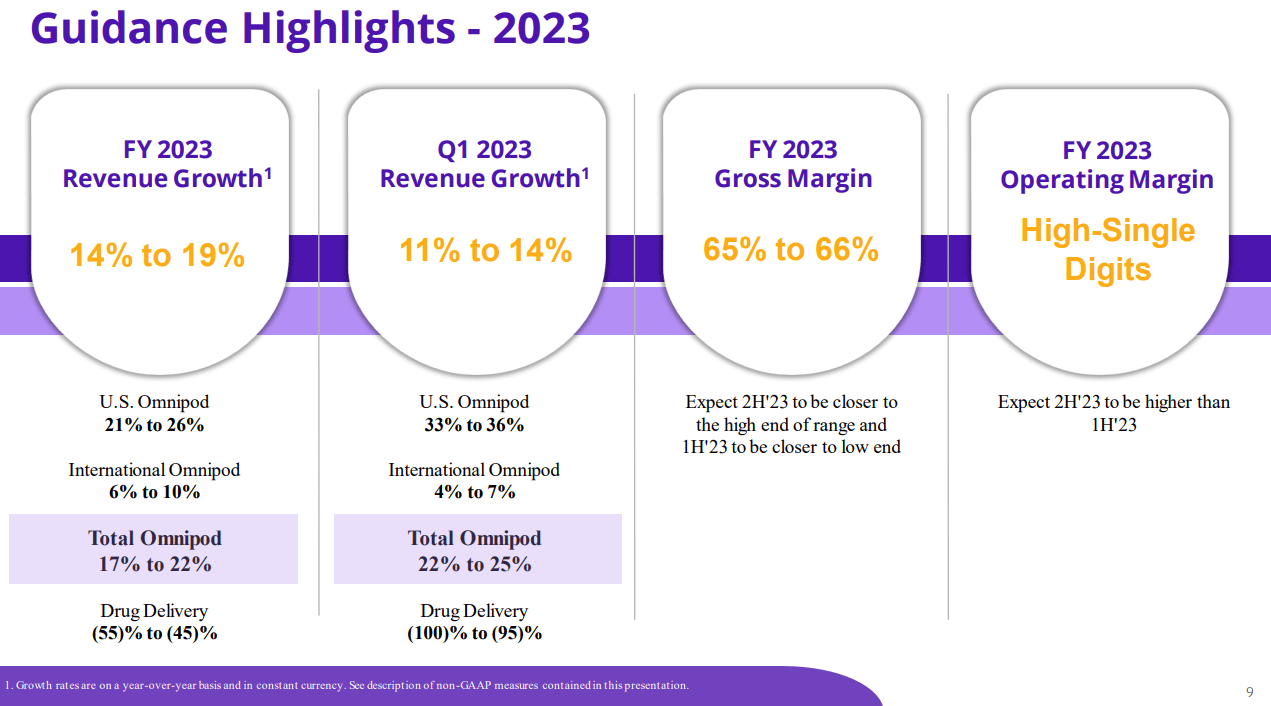

PODD: Positive Outlook (Source: Investor Presentation) From here, we can see PODD continue to show a steady increase of revenue in the range of 14% to 19% in FY'23. Furthermore, in terms of gross margin, the company saw a decline from 68.45% in FY'21, to 61.72% in FY'22. This could be attributed to the increasing costs associated with the ramp-up in manufacturing and product line mix due to the adoption of new products like Omnipod 5 and cost related with recent voluntary product recall. In fact, management sees an improvement of 65% to 66% in gross margin in FY'23. Although the company has been investing heavily in sales and marketing efforts and scaling support functions, which has impacted its profitability in recent years, it remains committed to margin expansion, as quoted below. We expect operating margin to be in the high single digits, similar to 2022 levels with significant improvement in the second half of the year over the first half due to timing of investments and improved second half gross margins. We remain committed to margin expansion, and we expect to begin to leverage this bolus of investments in 2024 and beyond. Source: Q4'22 Earnings Call Transcript

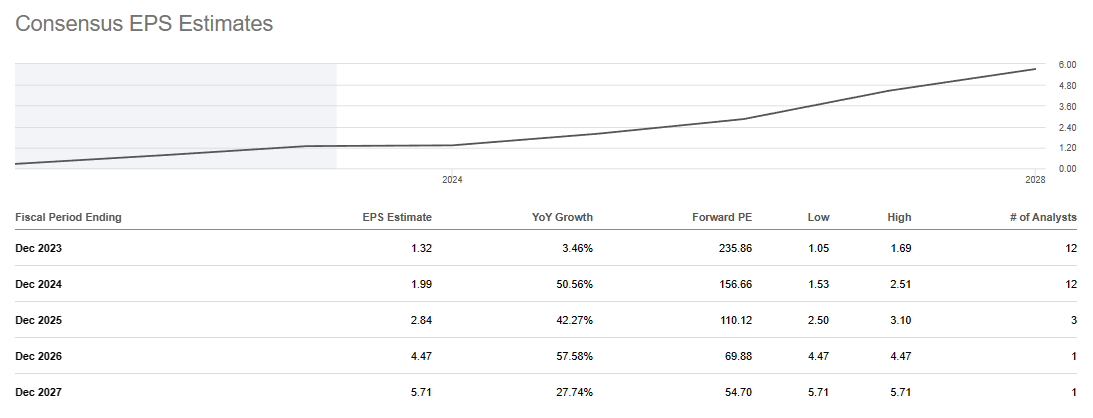

PODD: Growing EPS outlook (Source: SeekingAlpha Premium) There is no wonder why analysts are so optimistic about PODD, as shown in its growing EPS outlook, as shown in the image above. Rollercoaster Ride Continues

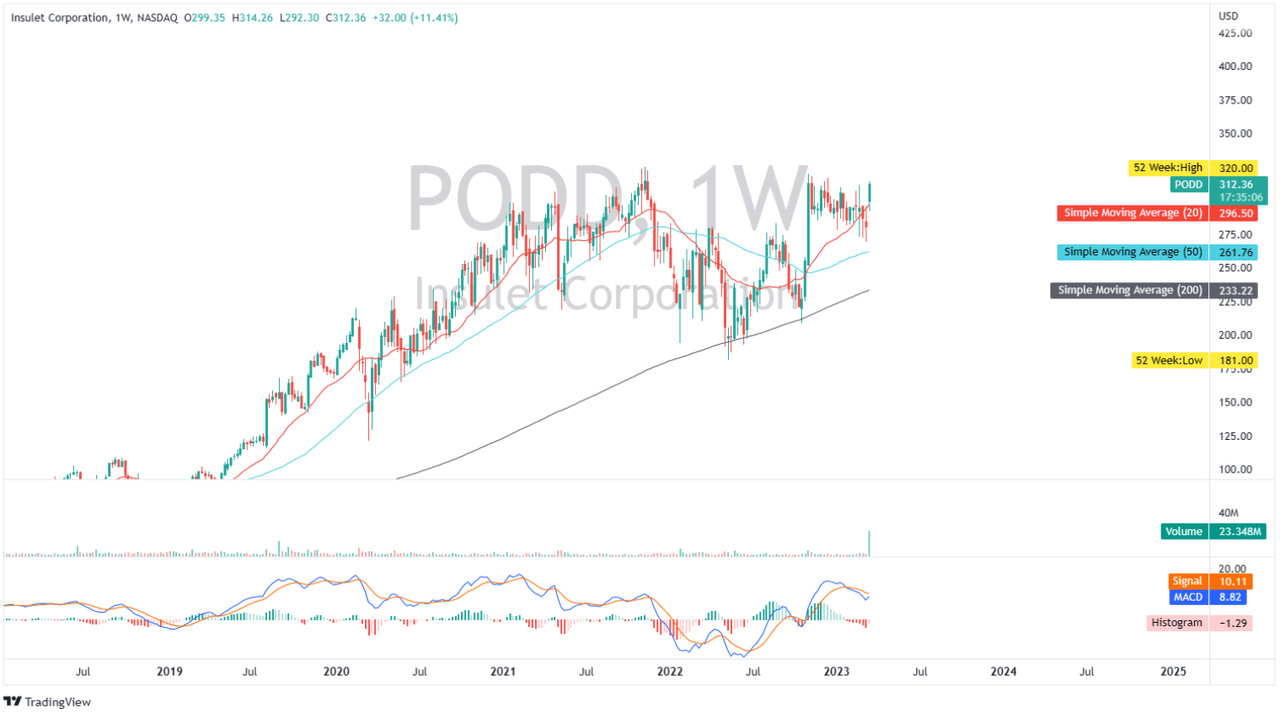

PODD: Weekly Chart (Source: Author's TradingView Account) PODD's recent performance in the stock market has been quite a rollercoaster ride. Over the past few months, the price of the stock has fluctuated significantly, with its low at $181 and a high at $320. However, it is currently retesting its 52-week high and has seen an increase in trading volume. This is likely due to the recent news of the company's inclusion in the S&P 500, which has garnered positive attention from investors. Furthermore, the bullish sentiment surrounding PODD is supported by its simple moving averages ("SMA"), with the 20-, 50-, and 200-day SMA all trading above each other. This suggests that the stock is in an uptrend and investors are optimistic about its future prospects. However, despite the positive indicators, there are some concerns to consider. The MACD has printed already bearish momentum, with a current value of 8.82, indicating some price action weakness. This could imply that there might be a correction in the stock's price in the near future. In the event of a pullback, it is essential to monitor the strong support level around $255. If the price were to fall to this level, it would represent an excellent opportunity for investors to buy the stock at a better price. In conclusion, while the current trend of PODD appears positive and its inclusion in the S&P 500 appears promising, it is important to consider the possibility of a market correction. Is PODD Really Overpriced? A Closer Look at the Numbers

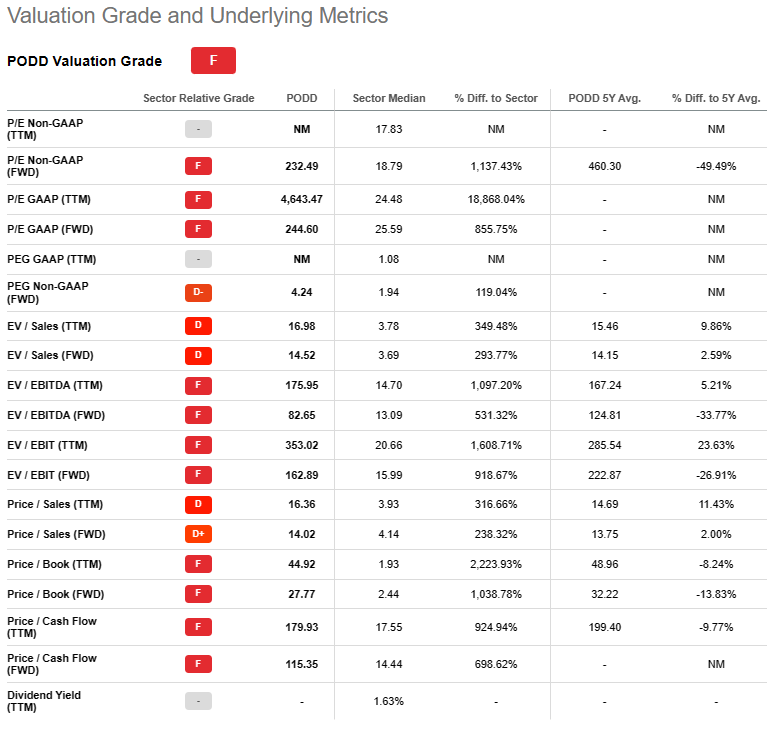

PODD: Unattractive Valuation Grade (Source: SeekingAlpha Premium) As a member of the S&P500, one would expect a compelling valuation for PODD. However, Seeking Alpha's valuation grade of F suggests otherwise. This signals that PODD trades at unattractive multiple as of this writing. Looking at the image above, its P/E ratios are expensive relative to its peers, as shown in the image below.

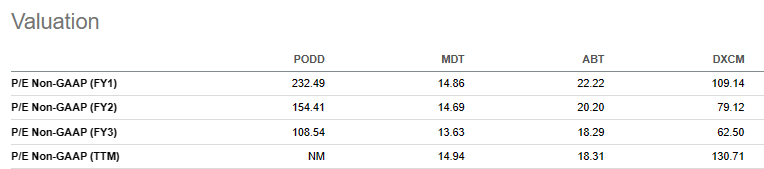

PODD: Relatively Expensive (Source: SeekingAlpha Premium) Medtronic plc (MDT), Abbott Laboratories (ABT), DexCom, Inc. (DXCM) The stock may appear overvalued based on its forward PEG ratio, indicating that its expected earnings growth rate may not be keeping up with its current price. However, a closer examination of its historical performance reveals a compelling opportunity. Currently trading at a forward EV/EBITDA of 82.65x, PODD is significantly cheaper than its 5-year average of 167.24x. As investors begin to recognize the strength of the company's moat and the potential for sustained growth, it is likely to continue trading at higher multiples than its peers. This makes PODD worth monitoring, particularly if the price drops to a more attractive level. Final Key TakeawaysDespite the prevailing uncertainties, PODD's balance sheet provides reassurance to investors, especially those with expertise in finance. While the company's cash and cash equivalents decreased from $791.6 million in FY'21 to $674.7 million in FY'22, leading to a decline in working capital, its lack of significant debt maturing before 2026 makes PODD a highly liquid company and less risky in today's unpredictable operating environment. However, today's weakness was manifested in the growing long-term debt, which has an unfavorable impact on the debt-to-equity ratio of 3x. This, in turn, contributed to the higher debt to EBITDA ratio of 10.63x, up from its 6.79x recorded in FY'21. With the guidance of the management and the growing total addressable market (TAM), PODD possesses significant growth potential, making it a stock worth monitoring. Thanks for reading and good luck! |

【本文地址】